“Memory is the mother of all wisdom.” — Aeschylus

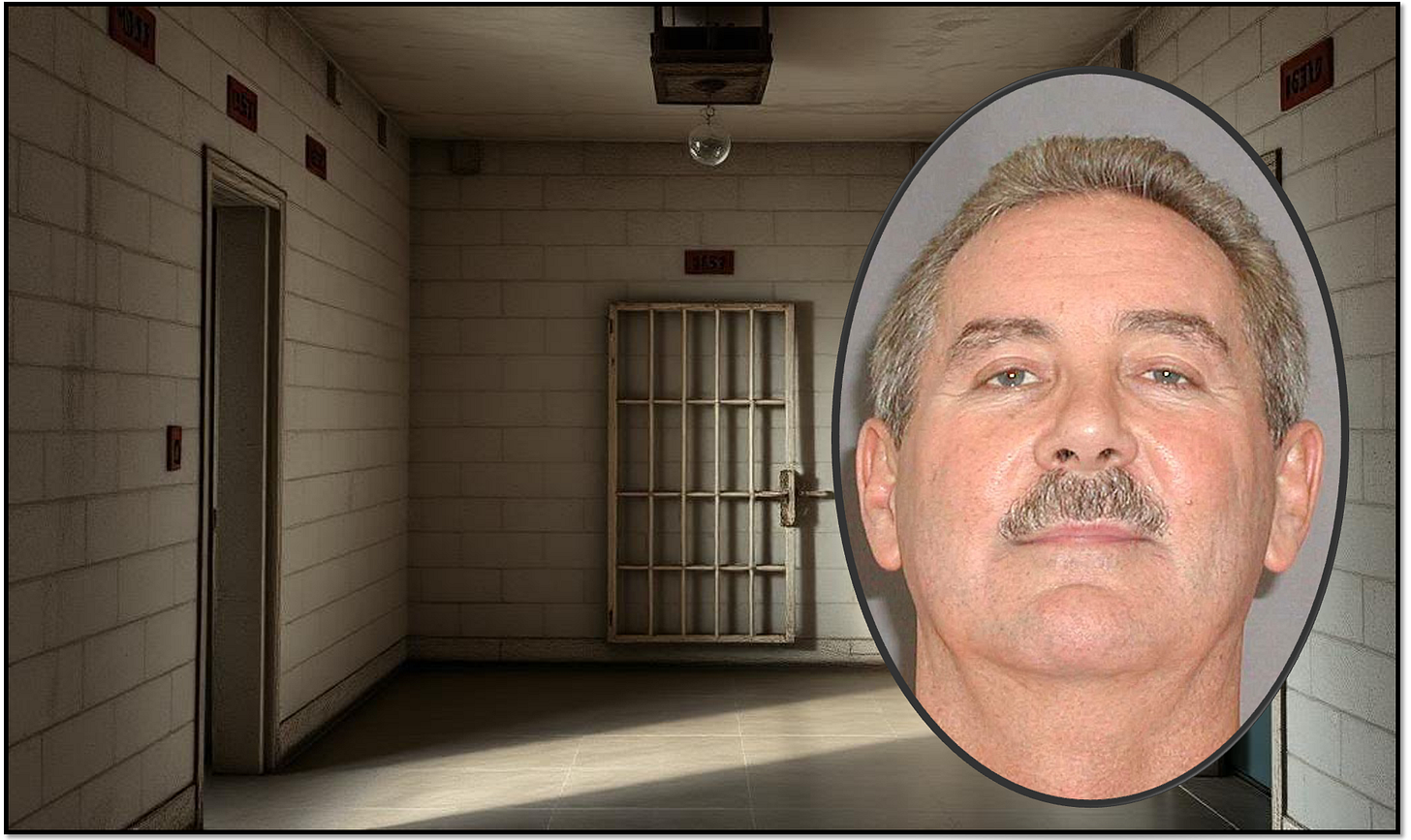

The best thing that you can do with a convicted swindler is lock him up – but don’t forget about him.

In 2009, Robert Allen Stanford was arrested for allegedly defrauding more than 30,000 investors in 113 countries. He stole more than $7 billion and he received a 110-year prison sentence after his 2012 conviction.

I’d written about his crimes several times, but I scantily remembered them until Thursday when a federal judge finally slapped Stanford with a $5.9 billion civil fine.

The judge also ordered Stanford Financial Group's former chief financial officer James Davis to pay $17.66 million and former chief accounting officer Gilberto Lopez to pay $3.42 million for their contributions to this massive global fraud.

What took the justice system so long? Who cares? None of this money is likely to be paid, especially with Stanford all brokey and in the pokey.

Stanford convinced his mostly foreign investors that their money was safely deposited in CDs while he spent it with abandon, destroying lives wherever he went.

Stealing as many billions he did, he should have been recognized as a Ponzi scheme superstar, but as I wrote in 2009, he was upstaged by Bernie Madoff, who was initially alleged to have stolen as much as $65 billion.

Because of the limelight on Madoff, Stanford was never able to achieve the infamy he deserved. In fact, everyone called him a mini-Madoff.

We still read about “mini-Madoffs” today because the Ponzi schemes keep coming. But you will never read about “mini-Stanfords” even though Stanford’s grift was truly enormous.

One of the greatest actors of our time, Robert De Niro, played Madoff in the May 2017 HBO film, The Wizard of Lies, based on the best-selling book by New York Times reporter Diana Henriques. Who played Stanford? Nobody. Not even Gary Busey.

Yet Stanford was far more colorful as a brash Texan with a name that was often mis-associated with a prestigious university. Madoff, by contrast, kept a low profile and described himself in media interviews as “this little Jewish guy from Brooklyn.”

At one point, Stanford was said to have a personal net worth of more than $2 billion. Madoff, by contrast, was said to be worth only about $800 million.

Stanford used his ill-gotten gains to create an international cricket league and name sporting venues named after himself. Madoff, who managed money for owners of the Mets, just had a few seats at the game.

Stanford also used his loot to take over the Caribbean island nation of Antigua and Barbuda, where he was officially knighted in 2006. Until he was finally stripped of his knighthood, people had to call him “Sir Allen.” Nobody had to call Madoff “Sir Anything.”

Madoff bought yachts and planes, but he leased space at marinas and airports. Never in his wildest schemes did he imagine taking over entire islands for his personal fleet.

Stanford also owned two newspapers in Antigua. And he was named “2008 Man of the Year” by London-based World Finance magazine. The magazine decided to forge ahead with this honor, dismissing the mounting allegations against Stanford as unproven rumors. Madoff never commanded this kind of love.

Madoff died in prison on April 14, 2021. Stanford is still kicking at age 74. He’s slated to be released in 2103 – plenty of time to build his brand and claim the infamy he deserves.

Business Blunders heightens awareness of the follies that plague America’s financial system. Please help make the business world a more honest, less reckless, less authoritarian place by:

Liking and commenting on posts, which boosts the Substack algorithm.

Sharing this newsletter with friends and associates.

Subscribing. Free or paid, I’m so glad you’re here.

Artificial Insolence

Enough has been written about DeepSeek already, be I’d be remiss if I didn’t mention the biggest techno blunder we’ve seen in decades.

All the billions pouring into artificial intelligence suddenly looked like a waste after the broader market heard that a Chinese company has developed AI that competes at a fraction of the price.

It’s called DeepSeek and it deeply sunk chipmaker Nvidia, which lost $600 billion in market value on Monday – the biggest one-day plunge for any company in market history.

The development proved U.S. efforts to limit advanced chips and technology to China were futile. Turns out Chinese companies can innovate without us. DeepSeek has become the top most-downloaded app and its capabilities leaves many in awe.

It was a huge humiliation for President Donald Trump, Silicon Valley, and Wall Street investors who’ve been running up AI stocks like Nvidia in a frenzy reminiscent of the dot com bubble.

Days before the DeepSeek market plunge, Trump announced Stargate, an effort to preserve U.S. AI dominance. SoftBank, Oracle and OpenAI pledged $500 billion to this plan for a massive AI infrastructure that may not be entirely needed.

As fellow Substacker Herb Greenberg noted earlier this week, DeepSeek highlights the absurdity we’re getting from the boisterous tech bros who appear to be taking over our nation.

A Guardian columnist called the feuding boy geniuses, Elon Musk and Sam Altman, “two of the world’s most powerful, overhyped and self-satisfied men.”

Don’t be fooled: These guys may be geniuses within a certain bandwidth, but their arrogance can only lead to more blunders. And at this point in history the stakes are high with AI threatening to end humanity as we know it.

Can I take a leak, or do I have to buy a Frappuccino?

Starbucks recently paid Brian Niccol $96 million upfront to become its new CEO and the guy can’t even make up his mind about who gets to use the bathroom.

Earlier this month, Niccol announced that only paying customers could use Starbucks’ bathrooms. Last week, he reversed himself.

Starbucks gave Niccol a fortune to leave his successful gig running Chipotle in August. But is any CEO really worth $96 million up front?

Not so far. Any top executive who makes a controversial decision and then swiftly reverses it leaves the impression he has no idea what he’s doing. Let’s hope Niccol has enough sense to check his zipper.

Another big reversal

President Donald Trump changed course on federal pay freezes this week. Some called it idiocy.

Others called it “genius.”

“This is Donald Trump. He throws hand grenades in the middle of the room, and then cleans it up afterwards,” Sen. Kevin Cramer of North Dakota told the Associated Press. “I just think the guy’s a genius.”

Yeah, sure. And whether you’re at Starbucks or the White House, don’t forget to flush.

Trumpflation

Trump somehow shocked the world by doing exactly what he said he was going to do: Impose steep tariffs on U.S. trading partners.

In the last edition of Business Blunders, I noted that Trump has abandoned his promise to end inflation on day one. I noted that his policies, including tariffs, are expected to be inflationary as they disrupt $21 trillion in trade.

The tariffs take effect today. And on Friday Trump said the disruption would be short-term. Reminds me of the promise Federal Reserve Chairman Jerome Powell made in 2021 calling inflation “transitory.”

Hedge fund from hell

Patrick Halligan, who served as chief financial offer of an imploded “Christian” hedge fund, received an eight-year prison sentence on Monday.

The collapse of Archegos Capital Management cost the world’s largest banks – including Nomura Holdings and Credit Suisse (now part of UBS), Morgan Stanley, and Goldman Sachs – a combined $10 billion.

At it’s peak, the firm managed $36 billion as its founder Bill Hwang boasted that he invested “according to the Word of God and the power of the Holy Spirit.”

Hwang was sentenced to 18 years in November. He and Halligan remain free on bond pending appeals.

It’s like the Bible says: “It’s easier for a camel to get to heaven that it is for a rich man to go to prison.” Or something like that. I’ve been missing Sunday school lately.

Don’t Miss These Blunders

Trumpflation Does anyone really think our new president can end inflation?

Drunks Wanted This Week in Blunders – Jan. 19-25

Blowing A Fartcoin Are meme coins heralding the next market crash?

Billionaires Are Destroying Everything, And They Know It The World Economic Forum's 2025 Global Risks Report is a roadmap for the devastation to come

Chicken Soup For The Soulless This Week In Blunders – Jan. 12-18

Can Musk Single-Handedly Capture A Regulator? A relatively petty case against the multibillionaire may signal who is really running the country

You Can Plunder, Too Private Equity firms want average Americans to join in the looting

Florida Man Goes To The Movies This Week In Blunders – Jan. 5-11

Bigots Fly Free United Airlines may be under fire for its diversity efforts, but it just settled a nasty racial discrimination case

Lock ‘Em Up Welcome to the Business Blunders Hall of Shame commemorating top business leaders convicted of felonies

Tip Your Banker? This Week in Blunders – Dec. 29 - Jan. 4

Business Blunders Hall Of Shame From magnate to inmate: These are the nation's most notable white-collar convicts

Unshackling Ponzi Perps It’s a bad idea to let convicted swindlers go free. Biden just gave clemency to a slew of them

Married To Madoff Victims of a fraud that regulators missed decades ago are finally getting most of their money back

MAGA Mad About Musk This Week in Blunders – Dec. 22-28

Biggest Business Blunders of 2024 It was an ignominious year for economic forecasters, CrowdStrike, Boeing, FTX, Mattel, Truth Social, Red Lobster, Fisker, Spirit Airlines, TicketMaster and the dumbest bank embezzler in history

Go To Zelle This Week in Blunders – Dec. 15-21

Basketball Jones Former Harlem Globetrotter and NC State point guard gets seven years for a Covid-19 loan scam

A CEO’s Road To Hell It began with forbidden love and ended in felony charges for Comtech’s Ken Peterman

Sorry About That Opiod Thing This Week In Blunders – Dec. 8-14

Spoiled, Rotten Day Trader Ian G. Bell touted a wealthy background to allegedly dupe investors in his money-losing investment scheme

Shot In The Back Did maddening back pain drive Luigi Mangione to murder UnitedHealthcare CEO Brian Thompson?

The Killionaire Here's why the man who gunned down UnitedHealthcare's CEO became an instant folk hero

Enron Was A Parody Of Itself Here's where CEO Ken Lay ate before he died

Big Blunders Come In Small Packages Macys blames an employee for hiding 'small package delivery' expenses. Anyone remember the boxes at Miniscribe?

Billion-Dollar Reprobate Bill Hwang lost billions investing 'according to the Will of God.' Now he's going to prison for cheating Wall Street banks

Hitting The 'Undo' Button At FTX Gary Wang wrote the code that enabled an $8 billion fraud. Prosecutors and a federal judge sang his praises

Ponzi Once, Ponzi Twice A New Jersey man got probation for running a $300 million scam. Then he launched a $658 million fraud with ads on Fox News

Hello? What About The $36 Trillion Tab? America's balance sheet is about to get worse and Republicans don't care

A Mouse That Roared A small-time CEO launched a proxy war with $17.32 in his company's brokerage account. Now he's going to prison.

Bozo Bezos The Washington Post's billionaire owner makes a clownish excuse for killing a presidential endorsement

CEOs Gone Wild Abercrombie & Fitch had to know its CEO was a freak

X Marks the Spot An Alabama man hacks the Securities and Exchange Commission with an iPhone, then returns it for a refund

Danger, Will Robinson Destiny Robotics promised AI-powered humanoids that could form meaningful relationships, but it delivered a wig stand

All the Kosher Meals You Can Eat Lufthansa gets sacked with a record fine for banning Jews from a flight

Magic Mushroom ‘Pump and Dump’ Here's what can happen when 'shroom heads take control of a penny stock

InHumana Bad reviews matter, and this health care insurer is paying a hefty price for ignoring them

And the Winner is … Walmart The nation's largest grocer must be loving government efforts to break up the $25 billion Kroger-Albertsons deal

The Incredible Shrinking Billionaire The chips are down for EchoStar's poker-playing Charlie Ergen

Plastic Balls ExxonMobil put polymers in our testicles

Bankster Bonus A top Old National Bank executive bags $2.6 Million after his arrest for allegedly molesting a child

Watery Grave CEOs usually don't implode as literally as OceanGate's Stockton Rush

Drivin’ that Train It's the end of the line for the embattled Norfolk Southern CEO

Stinky Stonk Anatomy of a nightmare investment that's poised to get worse

The Music Man Michael Smith allegedly played his AI-generated music billions of times to bots, ripping off streaming services and artists

One Sorry Ferrari Online gaming CEO hustles car broker and scams investors with an IPO that never happened

Adam Family Brothers allegedly raised $60 million with a phony crypto bot and spent investors' money on new homes and luxury goodsPiggy Banker A Bank CEO robs his own bank while crypto scammers rob him

Clowns In Court An FTX felon wants to take back his guilty plea after prosecutors charged his girlfriend with campaign finance violations

Piggy Banker A Bank CEO robs his own bank while crypto scammers rob him

The Wonders of Blunders Why I follow business failures, and why you should, too.

Holy Payday Batman A CEO bags $250 million driving his hospital chain into bankruptcy

Design Your Life An alleged Ponzi schemer bagged $1 million a day with happy talk

Nike Air Athletic-apparel giant's top executives preach climate change as they rev up their corporate jets

If you can't woo 'em, sue 'em Elon Musk ran off advertisers; now he's suing them for leaving

Drunken Chicken Tyson Foods' suspended chief financial officer could make a comeback

In Real Life A "serial founder" finds a serial sucker in SoftBank

Smoke on the Water Luxury Miami condo association sues to evict chain-smoking fraudster

Beyond Stupid TV stock tips are for chumps

Canary in a CrowdStrike Cybersecurity giant's blunder is a warning for the whole world

Boeing’s Lost Spirit Outsourcing proves bad for business

Lizards of Ozy The chameleons at failed Ozy Media are turning orange

A Harvard Business Blunder Graduates duped in a ridiculous Ponzi scheme

Con Air Fly the felonious skies with Boeing

Smell the Glove Milwaukee Tool reeks of forced Chinese labor, lawsuit alleges

Fisker the Frisker An electric car entrepreneur offers a valuable business lesson: If at first you don't succeed, file, file again

Musk Mouth It takes a genius a long time to address an obvious blunder

Sorry Seems To Be the Hardest Word A simple apology proved difficult for crypto tycoon Do Kwon after the $45 billion collapse of his Terraform Labs

Epoch Crimes The finance chief of a far-right publication allegedly went far wrong

Ticketbastard Live Nation deserves every ounce of contempt it has provoked

How to Boil a Lobster Endless shrimp didn't drive this soggy seafood chain into bankruptcy

Take Out Your Trash The Federal Deposit Insurance Corp. insures bank deposits, bullies, racists and sexual predators

Sam in the Slam FTX founder Sam Bankman-Fried invests in beans and rice

Billionaire Prison Time Here's how a hedge fund honcho managed incarceration

‘Bitcoin Jesus’ Saves Crypto promoter charged with dodging $48 million in taxes

The Power of Red Failed Republic First Bancorp learns that 'fans' are fickle

Our Deadhead Fed Head Jerome Powell has flubbed inflation

Google This Billionaire A Silicon Valley legend makes his dumbest trade ever

Don’t Listen to Sam Boeing engineer warns of 'catastrophic accidents and passenger fatalities'

Calling Spirit Airlines on the Ouija Board Will customers miss this carrier if it dies?

Musk’s F-Ing Message The genius of our age is scaring Tesla's customers

A CEO Who Made His Bed Mattress Firm's latest buyer may be short on memory foam

They Bought Crypto From a Klepto FTX founder Sam Bankman-Fried's trail of tears spills into court

What’s in Your Wallet? Abusing company credit cards is a common employee grift

My Latest Blunder Lessons from an epic failure at The Messengerding appeals.

We all know what the Bible says: “It’s easier for a rich man to go to prison than it is for a camel to go to heaven.” Or something like that. I’ve been missing Sunday school for a long time.

Another Ponzi scheme crook was Tom Krieger out of Minneapolis, Minnesota who scammed over 900 investors in the multi-millions through his investor notes with his company Aspirity. The case which was bought to court by the investors found him innocent of all charges, even though there was solid evidence that he was the brain behind it and how he used all of the money to his own personal advantage, meantime claiming bankruptcy. This was a criminal who shrewdly, meticulously manipulated the court system including attorney's, jury and Judge. The state found him innocent of all charges, he moved to Arizona bought a multimillion-dollar house, on the investors money even though he claimed was no longer there. Today he is living the millionaires life.

The state of Minnesota is a very corrupt state and most certainly favor the criminals.

This was a slam duck case and MN let this criminal walk free. Tom Krieger was/is a very sick man who gets off on manipulating people with lies and sweet talk meantime he's plotting their demise.