“In a hierarchy, every employee tends to rise to his level of incompetence.” – Laurence J. Peter.

Don’t worry about this week’s stock market crash, persistent inflation or the rising odds of a recession sparked by President Donald Trump’s chaotic tariff policies.

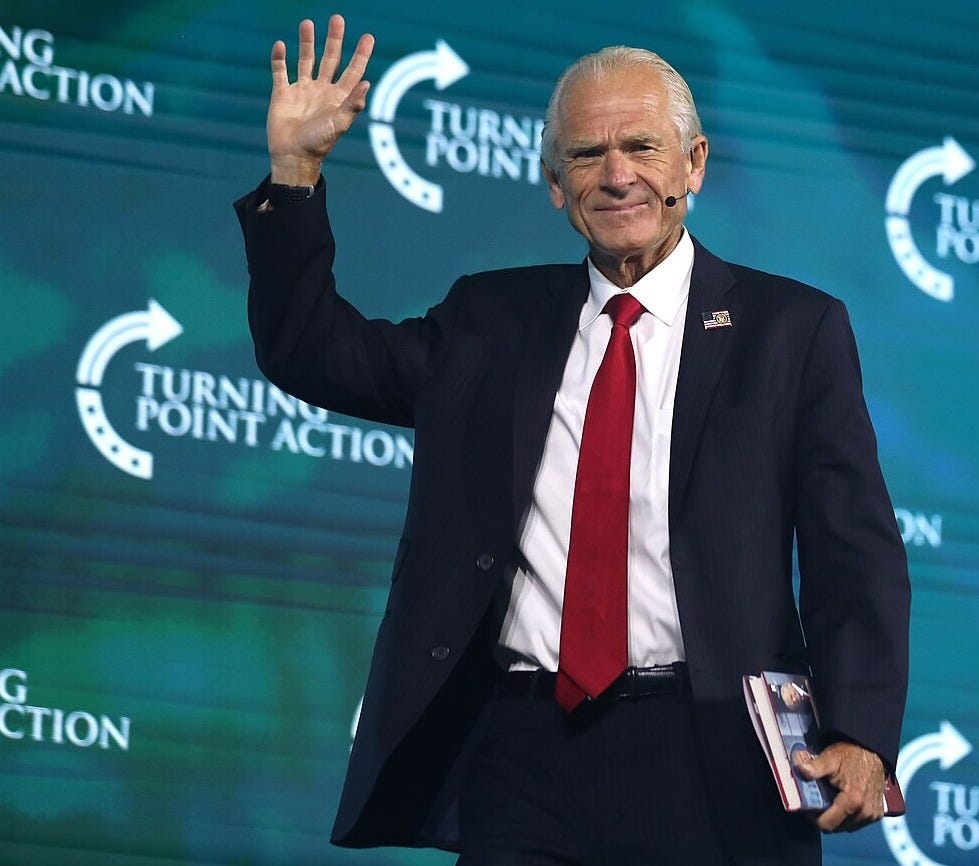

White House trade advisor Peter Navarro says life is going to be “beautiful.”

“The market will find a bottom. It will be soon, and from there, we’re going to have a bullish boom, and the Dow is going to hit 50,000 during Trump’s term,” he claimed on CNN today. “The S&P 500 is going to have a very broad based recovery, and wages are going to go up, profits are going to go up, and life is going to be beautiful here in America.”

Unfortunately, Navarro is a crackpot economist whose forecasts are often muddled with blind ideology, ridiculous conspiracy theories and dubious sources.

In his books, he quotes economist Ron Vara, who doesn’t even exist. He also quotes Leslie LeBon, who is simply his wife. Academics who make stuff up like this are typically dismissed – not elevated to senior counselor for trade and manufacturing to the president.

Navarro’s imaginary friend is an economist? What a dolt. Why he has any credibility with anyone is simply a manifestation of America’s festering ignorance epidemic.

Navarro is also a jailbird who served prison time after spreading election lies and refusing to comply with a Congressional subpoena.

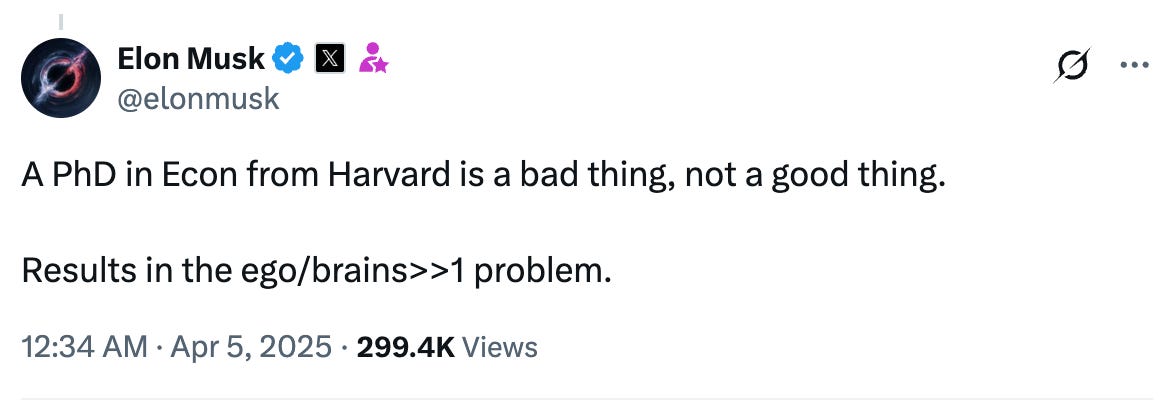

Not even Elon Musk will defend him.

Musk, who is still serving as Trump’s right-hand man, got on X this morning and slammed Navarro.

“A PhD in Econ from Harvard is a bad thing, not a good thing,” he wrote, adding that a degree from this prestigious school was a certification of more ego than brains.

Hmm. More ego than brains? Sounds like a projection.

For his part, Musk has transformed his auto brand into the next BudLight. Sales of Tesla were down 13% in the first-quarter, and even Fox News reports that his approval rating is smoldering like a Tesla Model Y.

Some people don’t understand why Musk is getting so much blowback.

I wouldn’t defend anyone who torches a Tesla, but let me try to explain: Can you imagine the outrage if former President Joe Biden had an Oval Office press conference with George Soros, and allowed the leftist billionaire’s crew of twenty-something hackers to manhandle government data?

Meanwhile, millions of investors are sweating the weekend with stocks headed for a bear market. The S&P is now down more than 17% from it’s all-time high and down more than 13% year-to-date. It could easily fall further when the market opens on Monday, as the situation did not improve going into the market close.

For once, there’s really only one cause for a massive market downturn and rising recession fears.

Watch for the quick recovery that numbskull Navarro predicts – or watch for America’s investing class to turn on Trump. Anyone losing money will not wait long.

Lose Max

Speaking of losing money, Newsmax investors are licking deep wounds following the conservative cable network’s initial public stock offering this week.

Newsmax went public at $10 a share on Monday and shot up like a Space X rocket to $265 a share. Then it imploded like a Space X rocket, settling at $45 on Friday.

[[[Don’t Miss: The Business Blunders Hall of Shame.]]]

Christopher Ruddy, a friend of US President Trump, founded Newsmax in 1998. And it’s still not profitable, according to a Newsmax regulatory filing.

Just goes to show that the old maxim about buying companies you know and love doesn’t always work out – especially if they are money losers to begin with.

And remember: Only insiders get the opening price of an IPO. Everyone else is rolling dice and all-too-often the greater fools.

Why are credit card rates so high?

Credit card companies charge usurious interest rates – averaging 23% in a 2023 count.

Research from the Federal Reserve released this week pokes at why. Yes, there are operational costs, marketing costs, and of course, the risk of borrower defaults. But the big reason?

“Our results indicate that credit card banks have significant pricing power,” the Fed report said.

Let me parse that: Banks charge you whatever they want – because they can.

Aren’t you glad we bailed them out after the 2008 financial crisis?

American Pie

The owner of Stash’s Pizza in Boston tried to solve problems all fast-food chains face: The rising cost of labor and not enough cash flow to make payroll.

Steve Papantoniadis, 50, attempted to force six employees to work for free by threatening to call immigration authorities and have them deported.

See, this is where so many Americans have our immigration policies all wrong. Small businesses are the economic engines of many communities and many of these enterprises run an underclass of workers that they can easily exploit.

Papantoniadis just took it too far.

He also physically threatened and abused his workers. For this, he was sentenced in October to 8.5 years in prison, one year of supervised release and ordered to pay a $35,000 fine.

But that’s not all.

On Wednesday, Papantoniadis received another two-year sentence with an order to pay $534,462.01 in restitution for loan fraud. After selling one of his restaurants, he claimed that he still owned it while taking out a $500,000 Economic Injury Disaster Loan from the Small Business Administration.

The program was designed to help small businesses that suffered economic losses during the pandemic – not to enrich a menacing pizza man.

But all is not lost. Perhaps Papantoniadis can try this handy jailhouse pizza recipe made with Saltine crackers and Cheese Whiz.

Don’t Miss These Blunders

Big Law Squeals Like A Pig Allegedly high-powered law firms prove they can't even defend themselves

JPMorgan Chumps A young fraudster duped the nation's largest bank out of $175 million. Now she doesn't want to wear her ankle bracelet

Loan Sharks, How Cliché This Week In Blunders – March 23-29

Bankrupt Barbie 23andMe's CEO Anne Wojcicki resigns as DNA testing company files Chapter 11

Send Musk To Mars This Week In Blunders – March 16-22

Netflop Somehow the streaming-video giant blew $55 million on a whack-job director

Slumlord Award This Week In Blunders – March 9-15

Getting The Lead Out Magellan executives lied about their blood-testing devices, putting thousands of lead-poisoning victims at risk

Suck-Up Sam This Week In Blunders - March 2-8

Aloha Suckers Another bankster holiday is in the making because Americans never learn

Croaking At Kroger Whatever this grocery giant's CEO did, it's costing him millions

A Bloody Mess This Week In Blunders - Feb. 23-March 1

All Fyred Up Again Billy McFarland is selling $25,000 tickets for Fyre 2. Who's in?

Natural Born Killers This Week In Blunders – Feb. 16-22

The Fugitive After three years on the run, a CNBC financial analyst pleads guilty to fraud

Property Sex A Justice Department crackdown on landlords who sexually harass tenants hasn't ended the nightmare

Battle Of The Oligarchs This Week In Blunders – Feb. 9-15

Freeing The Wolves The Foreign Corrupt Practices Act is on pause. Jordan Belfort fans never had it so good.

Money Mule This Week In Blunders - Feb. 1- Feb 8

China’s Jolly Rogers Anyone who knows what the Federal Reserve will do next can make billions. A senior Fed advisor allegedly sold China an insider track.

The Forgotten Ponzi This Week In Blunders – Jan. 26-31

Trumpflation Does anyone really think our new president can end inflation?

Drunks Wanted This Week in Blunders – Jan. 19-25

Blowing A Fartcoin Are meme coins heralding the next market crash?

Billionaires Are Destroying Everything, And They Know It The World Economic Forum's 2025 Global Risks Report is a roadmap for the devastation to come

Chicken Soup For The Soulless This Week In Blunders – Jan. 12-18

Can Musk Single-Handedly Capture A Regulator? A relatively petty case against the multibillionaire may signal who is really running the country

You Can Plunder, Too Private Equity firms want average Americans to join in the looting

Florida Man Goes To The Movies This Week In Blunders – Jan. 5-11

Bigots Fly Free United Airlines may be under fire for its diversity efforts, but it just settled a nasty racial discrimination case

Excellent blunder, Al.

Navarro reminds me of that line in "The Hunt for Red October," when 'Jack Ryan' is introducing himself to the Russian submarine captain. "I wrote a book on Russian Naval Operations," Ryan says. "Oh, yes," says the Russian Submarine Captain. "I read that book. Your conclusions were all wrong."

He may have a Harvard economics degree. He could easily have had one from the University of Chicago. Doesn't matter. The economic theories espoused from Robert Ringer (you remember him? "Restoring the American Dream") to Milton Friedman were all wrong. As evidenced by economic history. As for banks and credit cards: I've contended since we bailed out the 'too-big-to-fail' banks, instead of charging any of us mortgage rates at even 2% when they were getting money at 0%-0.25% from the Federal Reserve, they should have paid us to stay in our homes.

When's the last time anyone got 'interest' on their regular savings account? They won't even give you a toaster or a credit-card sized calculator for free.

Not exactly the "beautiful" life I was hoping for.