“I asked God for a bike, but I know God doesn't work that way. So I stole a bike and asked for forgiveness.” – Al Capone.

In the movies, criminals empty Brink’s trucks. In real life, they load them.

You can’t trust just any ol’ money mule when you’re peddling drugs, running guns, trafficking humans, or funding a local terrorist cell. Why not call a long-established cash-handling company that everybody trusts?

On Thursday, Brink’s became history’s first armored-car company to admit to criminal wrongdoing and cough up a hefty settlement to avoid prosecution.

One of its subsidiaries agreed to pay $42 million to settle criminal allegations from the Department of Justice and the Treasury Department’s Financial Crimes Enforcement Network.

“For years, Brink’s moved large sums domestically and across the Southwest border without required … controls, exposing the U.S. financial system to a heightened risk of money laundering, including from narcotics trafficking and other illicit activity,” FinCEN Director Andrea Gacki said in a press release.

The settlement agreement enumerates millions in suspicious shipments between San Diego, Miami and Tijuana.

Organized crime relies on a loose financial system to move money. The world’s largest financial institutions often face sanctions for turning a blind eye and deploying shoddy money-laundering controls.

Last month, Bank of America received a cease-and-desist order from the Office of the Comptroller of the Currency for its unsafe anti-money laundering practices.

Also last month, Block, owner of CashApp, agreed to pay $80 million to settle violations of money laundering laws in a case brought by 47 state agencies.

And in October, TD Bank (now part of Charles Schwab), pleaded guilty and agreed to pay more than $1.8 billion to settle a money laundering investigation.

“By making its services convenient for criminals, TD Bank became one,” said then-Attorney General Merrick Garland.

Despite his promises of deregulation, President Donald Trump will likely continue to enforce anti-money laundering laws, according to Barron’s:

“Enforcing measures that prevent financial crimes under the Bank Secrecy Act has historically drawn bipartisan support because criminal groups such as terrorist networks and drug traffickers—which benefit from laundering cash—threaten national security.”

Suspicious wire transfers are one thing, but who knew criminals could hire an armored truck to move their loot to the laundry?

It’s the perfect cover. What cop is going to pull over an armored truck and ask about the load of cash in the back?

Business Blunders heightens awareness of the follies that plague America’s financial system. Please help make the business world a more honest, less reckless, less authoritarian place by:

Liking and commenting on posts, which boosts the Substack algorithm.

Sharing this newsletter with friends and associates.

Subscribing. Free or paid, I’m so glad you’re here.

Oh, no. Not Barbie!

The Trumpflation cycle is off to an impressive start with President Donald Trump’s tariff attacks on our nation’s largest trading partners.

The stock market is on edge, Treasury yields are ticking higher, and consumer sentiment is sliding on heightened inflation fears.

Think prices are high now? The price of almost everything could be moving much higher, depending how Trump’s looming trade war plays out.

Mattel, which sources 40% of its products from China, says it may have to raise prices on toys such as Hot Wheels and Barbie.

Barbie, who absorbed many real-world lessons in her namesake 2023 film, is not surprised: “The real world is forever and irrevocably messed up.”

Dr. Feel Good couldn’t cut a like McKinsey

Prosectors continue cleaning up the nation’s opioid crisis.

On Thursday, a Louisiana doctor was sentenced to more than seven years in prison after dispensing 1.8 million doses oxycodone, hydrocodone and morphine. That’s a lot of dope for one dealer.

Dr. Adrian Dexter Talbot, 59, of Slidell, La., ran Medex Clinical Consultants in Slidell, La. He “routinely ignored signs that individuals frequenting Medex were drug-seeking or abusing the drugs prescribed,” the Justice Department said.

He also defrauded health care benefit programs out of more than $5.4 million – highlighting another reason why our health care premiums are too high.

More than 80,000 people die from drug overdoses each year, but since the opioid crisis crackdown, most overdose deaths have been attributed to fentanyl, the Associated Press reports.

Last month, consulting giant McKinsey & Co. struck a deferred prosecution deal and agreed to pay $650 million for its role in the opioid crisis with Purdue Pharma.

No such luck Talbot. He may have peddled a boatload of opioids, but he wasn’t big enough to score the kind of deal you can get when you run a giant corporation.

This fitness drink won’t make you smarter

A top executive from Boca Raton, Fla.-based fitness-drink maker Celsius faces 20 years in prison after pleading guilty to insider trading charges last week.

Former Vice President Stephen George, 54, of Parkland, Fla., worked in the company’s finance department for six years until April 2023. He netted more than $1.6 million in profits, leveraging insider information he took from the company on his last day.

Insider trading is an American past time, with new cases brought regularly, but George apparently never learned how to cover his tracks.

On his last day at work, he emailed himself internal data about the company’s yet-to-be-announced financial performance. (Emailed! Like no one is ever going to see that.) Then he bought 20,000 Celsius shares and 300 Celsius call options in online brokerage accounts.

What was this beverage industry executive drinking? Click, click, click. How much easier could he make it for the regulators to catch him?

Celsius hasn’t commented on the case. The company claims its beverages boost metabolism. Not cognition.

Hall of Shame announces two new inductees

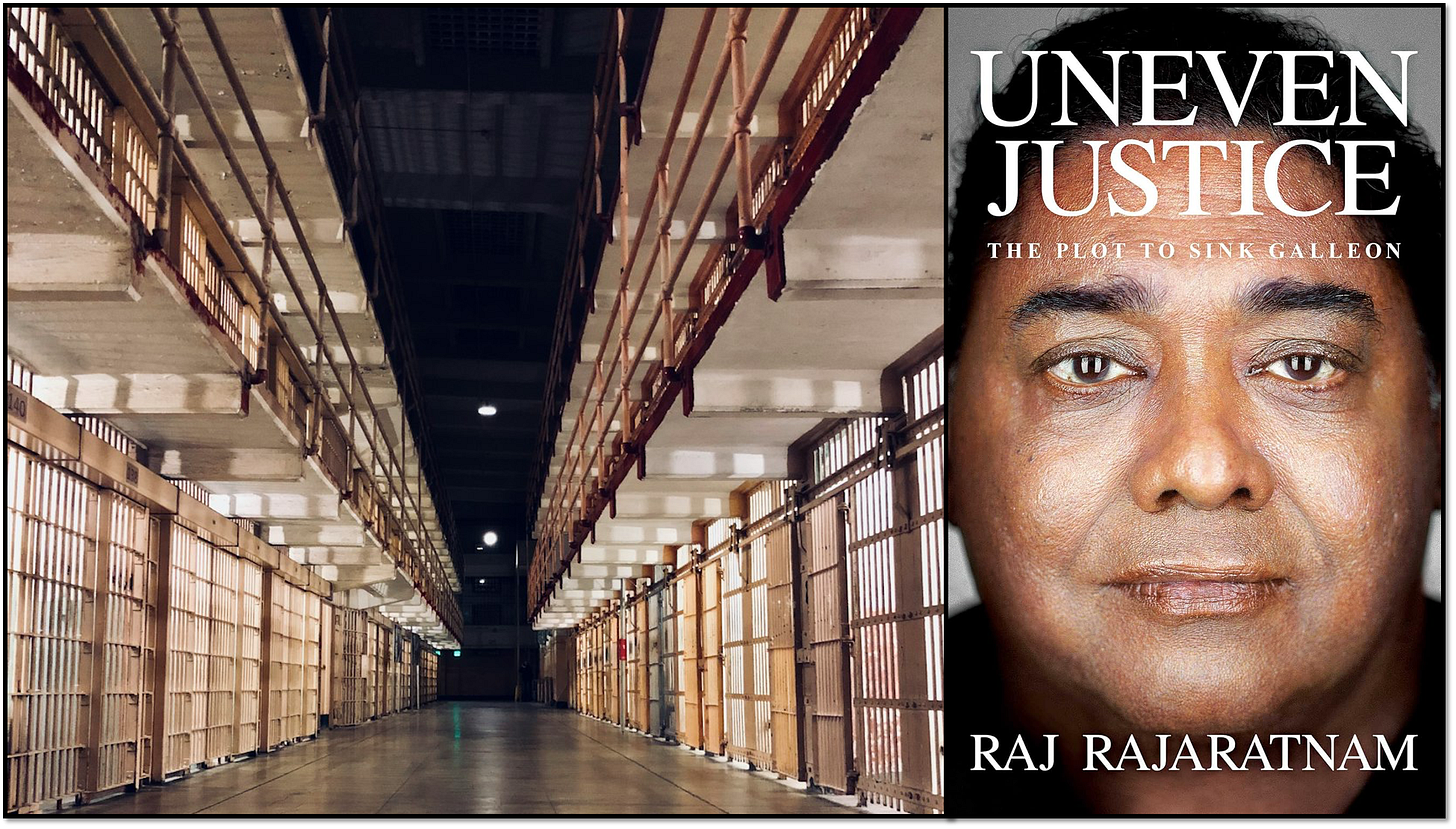

Please Welcome Raj Rajaratnam and Rajat Gupta to the Business Blunders Hall of Shame.

The two Rajs were prosecuted in one of the biggest insider trading cases that followed the 2008 financial crisis. Rajaratnam ran Galleon Group, a $7 billion hedge fund, and while Gupta was a director at Goldman Sachs, he fed Rajaratnam plenty of illegal stock tips.

They had a long-running business relationship and ended up playing bridge and chess with each other in prison.

Why dwell on the past? Because these crimes are still happening today. In fact, I have no problem digging up spectacular ripoffs every week. I fear our free-market economy has become so corrupt that grifting has become normalized.

Nevertheless, white-collar felons offer cautionary tales for investors, lenders, customers, employees and other stake holders. The Business Blunders Hall of Shame is an ongoing effort to shine a light what is often forgotten in the 24/7 news cycle.

The list of inductees is free, but the full exhibition is for paid subscribers. Paid subscribers can nominate potential inductees in the comments section. Click here for the criteria.

The anthology is nearing book-length, adding past and present scoundrels regularly. It’s fun reading and a reminder to be careful with your investment dollars and your careers.

Don’t Miss These Blunders

China’s Jolly Rogers Anyone who knows what the Federal Reserve will do next can make billions. A senior Fed advisor allegedly sold China an insider track.

The Forgotten Ponzi This Week In Blunders – Jan. 26-31

Trumpflation Does anyone really think our new president can end inflation?

Drunks Wanted This Week in Blunders – Jan. 19-25

Blowing A Fartcoin Are meme coins heralding the next market crash?

Billionaires Are Destroying Everything, And They Know It The World Economic Forum's 2025 Global Risks Report is a roadmap for the devastation to come

Chicken Soup For The Soulless This Week In Blunders – Jan. 12-18

Can Musk Single-Handedly Capture A Regulator? A relatively petty case against the multibillionaire may signal who is really running the country

You Can Plunder, Too Private Equity firms want average Americans to join in the looting

Florida Man Goes To The Movies This Week In Blunders – Jan. 5-11

Bigots Fly Free United Airlines may be under fire for its diversity efforts, but it just settled a nasty racial discrimination case

When I hear Brinks, I associate the ultimate in security. Sure got that wrong...

Can't wait to read about the bad behavior of journalists on the USAID take. The 4th estate has a lot of 'splaining to do.