“We've become, now, an oligarchy instead of a democracy. I think that's been the worst damage to the basic moral and ethical standards to the American political system that I've ever seen in my life.” - Jimmy Carter

Nobody knew how seriously to take Elon Musk when he challenged Mark Zuckerberg to a cage fight in 2023.

History might be different if these two cock fighters had jumped in the cage together, but the X owner chickened out as the Meta founder stood his ground.

Now there’s a reversal. Musk has Zuckerberg in a headlock as the unofficial, unelected president of the United States. And in response Zuckerberg has swung to the right like a partially immobilized wrestler trying to gain a foothold.

Zuckerberg has to curry favor with the administration to avoid sanctions against his own empire, which competes with Musk on several fronts, including artificial intelligence development.

Zuckerberg also wants the administration to target another arch competitor, Apple, CNBC reports:

“Zuckerberg hopes that Meta’s improved relationship with the White House could help put pressure on the iPhone maker, after a yearslong battle between the two tech heavyweights. Both companies were targets of antitrust suits from the U.S. government.”

Musk likely wouldn’t mind grinding up a little Apple sauce, either.

Trump has put him in charge of the unofficial Department of Government Efficiency, or DOGE, where he has stirred up all sorts of chaos. The bounds of his powers are unknown but they seem more impressive with each passing day. He’s even taken a seat at the Resolute Desk, at least on the cover of Time magazine.

This shouldn’t be a shock. Billionaire oligarchs replaced democracy years ago. They are just not hiding it anymore. We’ve now got one of the nation’s largest government contractors with his fingers in the federal pie.

Our only hope is that our corporate overlords will slowly destroy each other and leave us the wreckage.

OpenAI founder Sam Altman, a billionaire technologist with his own designs on the future, should be asking his artificial intelligence bots where all of this corporate corruption is headed.

Altman has a target on his back, too, because his company is winning the AI race, or at least it’s far ahead of Musk’s xAI, Tesla, SpaceX and other companies.

Musk made an unsolicited $97.4 billion takeover offer for OpenAI, but Altman turned it down, saying Musk is only trying to hinder his enterprise while Musk tries to catch up.

We’ll see how Altman fares in Stargate, Trump’s $100 billion venture to invest in computing infrastructure. He’d best be bulking himself up for a cage fight.

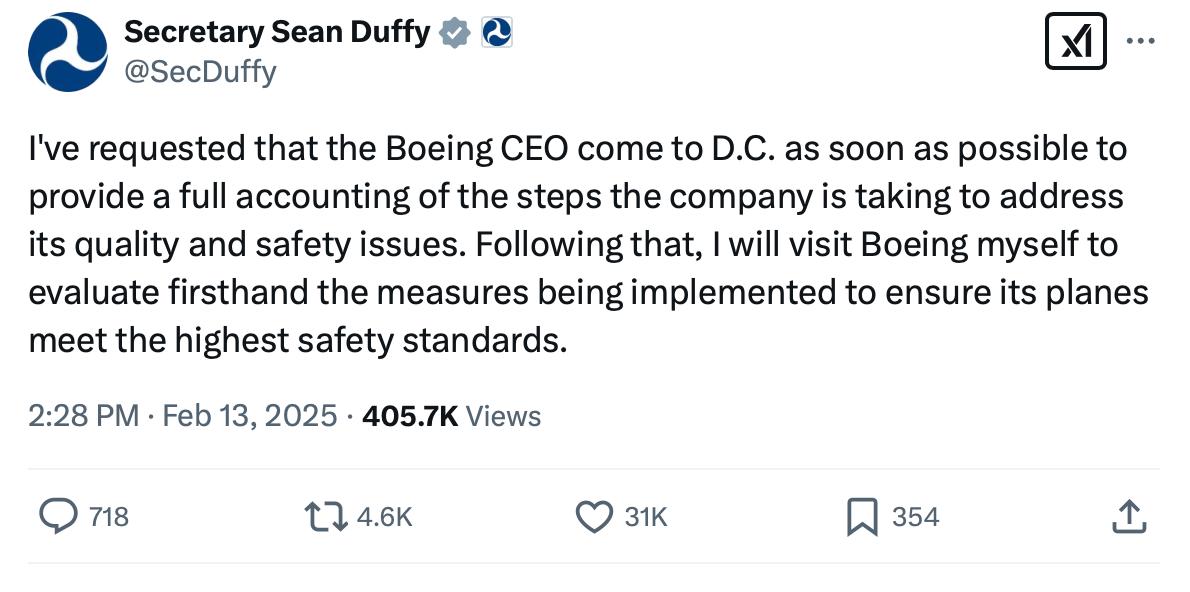

And then there’s Boeing. As if The aerospace giant doesn’t have enough trouble as it recovers from plane crashes, quality issues, criminal charges and massive losses, the Trump administration is ordering its relatively new CEO Kelly Ortberg to Washington D.C. ASAP.

Boeing, of course, competes with Musk for government contracts.

And President Donald Trump is already unhappy with the beleaguered jet maker. He complains that Boeing is trying to wiggle out of a deal to build two new Air Force One planes.

“Boeing, we’re not happy with the service we’re getting in terms of those planes,” he told reporters gathered in the Oval Office on Wednesday.

As a gargantuan government contractor, Boeing is clearly in harm’s way with Musk in charge. Don’t be surprised if it gets BULL-DOGED.

Business Blunders heightens awareness of the follies that plague America’s financial system. Please help make the business world a more honest, less reckless, less authoritarian place by:

Liking and commenting on posts, which boosts the Substack algorithm.

Sharing this newsletter with friends and associates.

Subscribing. Free or paid, I’m so glad you’re here.

Shut up, Ken

There’s nothing more useless than listening to billionaire hedge fund managers as they talk their books.

Last week, Citadel CEO Ken Griffin was ragging about Trump’s tariffs at a UBS Financial Services Conference in Key Biscayne, Fla.:

“From my vantage point, the bombastic rhetoric, the damage has already been done. … It’s a huge mistake to resort to this form of rhetoric when you’re trying to drive a bargain because ... it tears into the minds of CEOs, policymakers that we can’t depend upon America, as our trading partner.

“It makes it difficult for multinationals, in particular, to think about how to plan for the next five, 10, 15, 20 years, particularly when it comes to long lead time capital investments that could be adversely impacted by a degradation of the current terms of engagement as amongst the leading Western countries when it comes to terms and trade.”

Maybe you saw Griffin portrayed in the 2023 film “Dumb Money,” about the wild-riding meme stock of GameStop. Griffin wasn’t too happy about the movie depicting him in unethical dealings aimed at protecting GameStop from an army of short sellers. Maybe he has a point. It’s a movie. But, geez, what a whiner!

Now he’s whining about Trump’s tariffs even though he’s a huge Republican donor and voted for Trump.

What did he think would happen? Trump made no secret about his plans for tariffs during his campaign.

Who is the dumb money now, Ken?

SEC hacker pleads guilty

The jobless food-delivery driver who hacked the Securities and Exchange Commission’s X account last year pleaded guilty on Monday.

Eric Council Jr., 25, of Athens, Ala., faces up to five years in prison for tweeting in the name of then-SEC Chairman Gary Gensler on the agency’s account. His tweet reported that the agency had just approved Exchange Traded Funds for bitcoin.

The fake news sent bitcoin soaring by as much as $1,000 until Gensler announced on his personal X account that the agency had been hacked. Then bitcoin fell $2,000.

Oddly enough, about 24 hours later, the SEC did in fact approve bitcoin ETFs – but the hack represented a high-profile blunder that brought a bipartisan backlash upon the regulator and put a political target on Gensler’s back.

Council didn’t pull off this feat on his own. He didn’t even have enough sense to ditch his phone after the crime, and his indictment mentions unnamed co-conspirators who may have profited the most from this crime. We’ll see if they’re ever named.

Meantime, what a blunder for the SEC to be embarrassed by a twenty-something slacker from Alabama.

If a hack this detrimental had happened at publicly traded company, the SEC would be burying it in lawsuits.

“This failure is unacceptable,” House Financial Services Committee members wrote in a letter to Gensler. “And it is disturbing that your agency could not even meet the standard you require of private industry.”

Change back from your $20?

Sales are sliding at McDonald’s, mostly because of an E. coli outbreak, but inflation and higher wages can’t be helping either.

I hate to air my personal beef against an American icon, but I only go to McDonald’s about once a year. Each time, I swear I’m never going back, and yet somehow I forget this promise and return.

The restaurants often smell funny, there’s usually no one at the counter, the electronic ordering kiosk is a poor replacement for customer service, the food isn’t as good as it used to be, and it costs more than $10 to get in and out of there with a load of grease in your stomach.

I know prices are out of control everywhere, but I just feel robbed. No wonder they brought back the Hamburglar.

I used to get two burgers, fries and Coke, and still get change back from my dollar. Anyone else remember those days?

Sounds like I’m making this up, but here’s proof:

Hall of Shame adds a new inductee

Please Welcome sham hedge fund manager Samuel Israel III to the Business Blunders Hall of Shame.

In the mid-2000s, Israel not only cheated his investors at Bayou Group out of $450 million, but he also stiffed Donald Trump out of $64,000 in rent payments.

And instead of reporting for prison, Israel famously faked his suicide and tried to make a run for it in a recreational vehicle.

It’s a harrowing tale of deception and such utter incompetence that we’re left to wonder why any sophisticated investor would have trusted this guy with a dime.

Why dwell on the past? Because nobody seems to learn from it. Here’s a Justice Department press release from just this week about a hedge fund manager ripping off his investors to pamper himself with luxury goods.

White-collar felons offer cautionary tales for investors, lenders, customers, employees and other stake holders. The Business Blunders Hall of Shame is an ongoing effort to shine a light what is often forgotten in the 24/7 news cycle.

The list of inductees is free, but the full exhibition is for paid subscribers. Paid subscribers can nominate potential inductees in the comments section. Click here for the criteria.

Don’t Miss These Blunders:

Freeing The Wolves The Foreign Corrupt Practices Act is on pause. Jordan Belfort fans never had it so good.

Money Mule This Week In Blunders - Feb. 1- Feb 8

China’s Jolly Rogers Anyone who knows what the Federal Reserve will do next can make billions. A senior Fed advisor allegedly sold China an insider track.

The Forgotten Ponzi This Week In Blunders – Jan. 26-31

Trumpflation Does anyone really think our new president can end inflation?

Drunks Wanted This Week in Blunders – Jan. 19-25

Blowing A Fartcoin Are meme coins heralding the next market crash?

Billionaires Are Destroying Everything, And They Know It The World Economic Forum's 2025 Global Risks Report is a roadmap for the devastation to come

Chicken Soup For The Soulless This Week In Blunders – Jan. 12-18

Can Musk Single-Handedly Capture A Regulator? A relatively petty case against the multibillionaire may signal who is really running the country

You Can Plunder, Too Private Equity firms want average Americans to join in the looting

Florida Man Goes To The Movies This Week In Blunders – Jan. 5-11

Bigots Fly Free United Airlines may be under fire for its diversity efforts, but it just settled a nasty racial discrimination case

BTW, right there with you on the outrageous prices for Mickey D's. Used to be "change back from your dollar" (which later became their 'dollar menu,' except a combo wasn't $1.00 just 1 item, like a burger or fries. Then it was 'change back from your $5.' Now it's 'change back from your $20.' And the food hasn't improved; the entire franchise hasn't improved. It's only gotten bigger, and became the biggest in the 70s-80s when, because of it, "where's the beef?" became a campaign slogan (and also helped Wendy's grow, and Burger King grow, to compete).